The path to greater savings depends on choosing the right financial rhythm for your life.

The ultimate goal of any budget is simple: to help you spend less than you earn and save the difference. But does the frequency of your budget—weekly check-ins versus a monthly overview—actually impact the bottom line? With consumer finance reports suggesting over 63% of Americans now use structured budgeting to cope with expenses, choosing the right system is more relevant than ever . Let's cut through the noise and examine which method, weekly or monthly, is proven to put more money in your savings account.

The Head-to-Head Breakdown

To understand which method saves more, we must first understand their core mechanics, advantages, and pitfalls.

The Weekly Budget

The agile, high-control method for active money managers.

A weekly budget means planning your finances in 7-day sprints. You divide your monthly income into smaller, more manageable chunks (about 4.3 weeks per month) and focus on controlling your spending within each short window .

Why It Saves Money:

- Tighter Control: Smaller numbers are psychologically easier to manage. Managing $200 for weekly groceries feels more tangible than an $800 monthly sum, reducing the chance of early-month overspending .

- Faster Feedback: You catch overspending mistakes within days, not weeks, allowing for immediate correction .

- Easier Recovery: A bad spending week ends in just 7 days. You get a fresh start quickly, preventing a single mistake from derailing an entire month's plan .

- Ideal for Variable Income: Perfect for freelancers or gig workers, as it aligns budgeting with fluctuating cash flow .

Potential Challenges:

- More Time-Consuming: Requires a weekly review session, which can feel like a chore for some .

- Can Feel Restrictive: The constant monitoring may lead to "budget fatigue" for those who prefer a hands-off approach .

- Harder for Big Bills: Planning for large, static monthly expenses like rent requires dividing them mentally across weeks .

The Monthly Budget

The classic, big-picture approach for structured planners.

The traditional monthly budget involves one planning session at the start of the month, allocating your income across all expenses and goals for the next 30-31 days. It's the natural rhythm for salaried employees and fixed bills .

Where It Excels:

- Comprehensive Overview: You see your entire financial month at once, making it easier to plan for savings goals and debt payments .

- Less Frequent Management: One major session per month means less day-to-day money stress for disciplined individuals .

- Aligns with Fixed Expenses: Naturally fits rent, mortgage, insurance, and subscriptions that are billed monthly .

- Simpler for Steady Income: Streamlined for those with predictable paychecks and expenses .

Where Savings Leak:

- The Mid-Month Slump: It's easy to lose track and overspend in the first two weeks, leading to a stressful, restrictive final fortnight .

- Slower Course Correction: A budgeting error on the 5th might not be caught until the 30th, by which time significant damage is done .

- Psychological Distance: A large monthly number can feel abstract, making it easier to justify small, frequent purchases that add up .

So, Which One Actually Saves More Money?

The evidence points to a nuanced answer: Weekly budgeting creates the behavioral conditions that enable greater savings for most people, but it's not the only factor.

Weekly budgets win on behavioral control. The shorter timeframe leverages our psychology: small numbers are less intimidating, frequent check-ins build accountability, and the promise of a fresh start is always just days away . This system is exceptionally effective at curbing the discretionary "wants" spending that silently drains monthly budgets—things like dining out, impulse buys, and entertainment .

However, a monthly budget is superior for strategic allocation. It ensures your essential bills, debt payments, and long-term savings contributions (like retirement funds) are prioritized as non-negotiable line items before any weekly spending begins .

The Verdict: If you struggle with daily spending discipline, switching from monthly to weekly budgeting will almost certainly help you save more by plugging those small, frequent leaks. But for truly optimized savings, you shouldn't have to choose.

The Champion's Strategy: The Hybrid Budget

The most effective system for maximizing savings isn't weekly or monthly—it's weekly and monthly. This hybrid approach, recommended by financial experts, combines the strengths of both to cover their weaknesses .

Monthly Planning

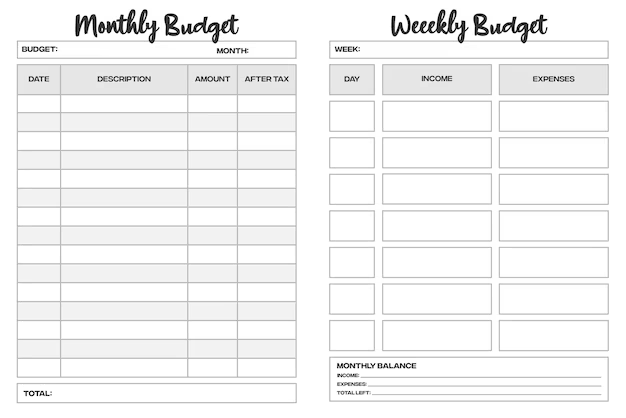

For bills, savings, & debtWeekly Control

For groceries, fun, & daily spendingHow to Implement the Hybrid System:

- Plan Monthly First: At the start of the month, use your take-home income to budget for all fixed costs (rent, utilities, insurance, subscriptions) and financial goals (savings, debt payments, investments). Automate these transfers if possible .

- Break Down Variables Weekly: Take what's left—your discretionary spending for groceries, dining, gas, and entertainment—and divide it by 4.3. This is your weekly "spending allowance" .

- Track & Reset Weekly: Each week, only spend from that week's allowance. Use cash envelopes, a separate debit card, or a budgeting app to track it. When Sunday comes, any leftover rolls into your savings, and you refresh with the next week's allowance .

This method gives you the long-term stability of a monthly plan with the daily anti-overspending defense of a weekly budget. It’s the system that consistently helps people like "Emma, 27" stay on track and build emergency funds .

Find Your Budgeting Personality

Not sure where to start? Your lifestyle and habits hold the answer. Take this quick quiz to see which method (or hybrid) aligns with your financial personality.

What's Your Budgeting Style?

1. How would you describe your income?

2. When you get a large sum of money (like a monthly paycheck), you tend to:

3. How do you feel about tracking your spending?

4. Your biggest budgeting struggle is usually:

Your Action Plan: Making the Switch

Ready to try the method that could save you more? Here's how to transition smoothly.

Switching from Monthly to Weekly/Hybrid:

- Recalculate Your Income: Don't just divide by 4. Find your true weekly income by dividing your monthly take-home pay by 4.3 (the average number of weeks in a month) .

- Isolate Your "Weekly" Categories: Focus only on variable spending for your weekly budget: groceries, dining, fuel, personal care, and entertainment. Leave rent, savings, and debt payments in the monthly plan.

- Choose a "Reset Day": Pick a consistent day, like Sunday, to review last week's spending and set your allowance for the week ahead .

The Final Tally on Savings

The question isn't merely "weekly vs. monthly?" but "which system gives me the structure and feedback needed to spend intentionally?"

For pure, unadulterated defense against discretionary overspending, the weekly budget is the superior tool. Its psychological advantages and rapid feedback loop make it harder for money to slip through the cracks .

For holistic financial health and achieving major goals, the structure of a monthly plan is essential. Yet, without weekly-style controls, it remains vulnerable to death by a thousand small cuts.

Therefore, the system that saves the most money for the most people is the hybrid model. It uses the monthly budget as a strategic blueprint and the weekly budget as a tactical spending guardrail. This combination provides the clarity, control, and flexibility needed to not just track your money, but to truly command it—and watch your savings grow as a direct result.