The 50/30/20 rule offers a clean framework, but real-life budgets are rarely so neatly divided.

The 50/30/20 budget rule is one of personal finance's most enduring pieces of advice: spend 50% of your after-tax income on needs, 30% on wants, and save 20%. It's simple, memorable, and offers instant structure to a daunting task . But in 2025, as living costs shift and financial goals become more personal, many find this tidy formula falling apart. This guide explains the rule's core principles, reveals exactly why it fails for so many people, and provides a practical roadmap to better alternatives that fit your actual life .

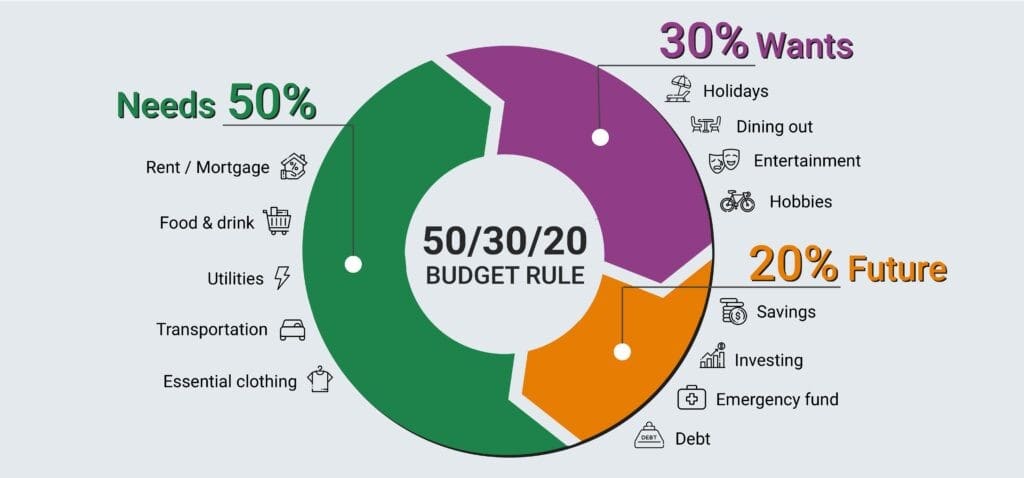

The 50/30/20 Rule at a Glance

This percentage-based method splits your take-home pay into three broad categories:

Needs

Essential expenses required for basic living and working: housing, groceries, utilities, transportation, insurance, minimum debt payments, and healthcare .

Wants

Discretionary spending that enhances your lifestyle: dining out, entertainment, hobbies, vacations, subscriptions, and non-essential shopping .

Savings & Debt

Money for your future and financial security: emergency funds, retirement investments, extra debt payments, and savings goals like a house down payment .

Calculate Your 50/30/20 Split

See what the rule suggests for your monthly budget. Enter your monthly take-home pay after taxes.

Needs (50%)

$2,000Housing, groceries, utilities, insurance

Wants (30%)

$1,200Dining, entertainment, hobbies, shopping

Savings (20%)

$800Emergency fund, retirement, debt payoff

The Core Problem: A "One-Size-Fits-All" Rule in a "One-Size-Doesn't-Fit-All" World

The fundamental flaw of the 50/30/20 rule is its rigidity. It assumes a level of financial stability and proportionality that doesn't exist for millions of people . As one critic puts it, it's "letting the tail wag the dog"—your arbitrary percentages set your goals, when your specific goals should dictate your budget .

The Harsh Reality Check

Data reveals a major disconnect: the median U.S. household brings home about $5,406 monthly, but the average household spends about $4,500 just on essential needs (housing, food, transportation, healthcare). That's over 80% of income on needs alone, far exceeding the rule's 50% allocation, leaving no room for its 30% wants or 20% savings . If your basic survival costs break the formula, you haven't failed—the formula has failed you.

When the 50/30/20 Rule Fails: 5 Common Scenarios

High Cost of Living Areas

In cities like New York or San Francisco, rent alone can consume 50% or more of a paycheck. The rule's math becomes impossible from the start, making savers feel guilty for circumstances beyond their control .

Irregular or Low Income

Freelancers, gig workers, or those in entry-level jobs have fluctuating or low earnings. Budgeting on fixed percentages is impractical when your baseline income can't cover the 50% needs category .

Significant Debt Burden

The rule lumps debt repayment into the 20% savings category. If you have high-interest credit card or student loan debt, allocating only 20% to both saving AND aggressive debt payoff slows your progress dramatically .

Aggressive Financial Goals

If you aim for early retirement, a large home down payment, or starting a business, saving 20% may be far too little. The rule can encourage complacency and limit your growth potential .

The Blurry Line Between Needs & Wants

Is a gym membership for health (a need) or luxury (a want)? Is a reliable car for work (a need) or a desire for comfort (a want)? The rule's rigid categories create confusion and justification for overspending .

The Pros: Why It's Popular

- Simplicity & Structure: Provides an easy-to-remember starting point for complete beginners .

- Prioritizes Saving: Builds the "pay yourself first" habit by making savings a visible category .

- Flexible for Variable Income: Percentages can be applied to any paycheck size, helpful for freelancers .

- Teaches Spending Limits: Encourages living below your means and categorizing expenses .

The Cons: Where It Falls Short

- Unrealistic Percentages: For many, needs exceed 50%, making the rule mathematically impossible .

- Undermines Debt Payoff: Groups debt with savings, slowing progress on high-interest debt .

- Promotes Lifestyle Creep: As income rises, the 30% wants category grows, potentially discouraging increased saving .

- Goal-Blind: Doesn't adjust for personal savings targets like early retirement or major purchases .

5 Flexible Budgeting Alternatives for 2025

When the 50/30/20 rule doesn't fit, choose a method designed for your reality. The best budget is the one you can stick with .

Alternative Budgeting Methods

1. Zero-Based Budgeting

Best for: Total control and intentionality with every dollar.

Your income minus your expenses equals zero. You "give every dollar a job" each month, whether for bills, savings, or spending. This method is fully customizable to your exact expenses and goals, making it more intentional than percentage-based rules . Example: On a $2,500 income, you assign $1,000 to rent, $400 to groceries, $300 to debt, $250 to savings, and so on, until $0 remains unassigned.

2. Pay-Yourself-First Budgeting

Best for: Building savings habits and securing your future.

Flip the script: decide on a savings goal (e.g., 15% for retirement, 5% for emergency fund) and transfer that money immediately when you get paid. You then live on the remaining money without strict categories. This guarantees progress toward your most important goals .

3. The Envelope System (Digital or Cash)

Best for: Visual learners and controlling overspending.

Allocate cash or dedicated digital funds to specific spending categories (Groceries, Dining, Entertainment). When an "envelope" is empty, spending in that category stops for the month. It’s a powerful visual tool to prevent overspending .

4. The 80/20 Budget

Best for: Beginners overwhelmed by details.

The ultimate in simplicity. Automatically save 20% of your income. Use the remaining 80% for all your expenses—needs and wants combined—without further tracking. It's less granular but builds a strong savings habit effortlessly .

5. The Irregular Income/Baseline Budget

Best for: Freelancers, gig workers, and anyone with variable pay.

Base your essential budget on your lowest expected monthly income. All expenses for needs are covered by this "baseline" amount. Any income earned above that baseline gets allocated to wants, savings, and debt as it comes in. This provides stability amidst uncertainty .

How to Choose Your Budgeting Method

Your budget should be a tool, not a test. Ask yourself these questions:

- What is my biggest financial priority right now? (Aggressive debt payoff → Zero-Based or Pay-Yourself-First with focus on debt).

- Do I have a steady or irregular income? (Irregular → Baseline Budget).

- Am I a visual/hands-on learner or do I prefer automation? (Visual → Envelope System; Automated → 80/20 Budget).

- Do I need extreme detail or just general guidance? (Detail → Zero-Based; Guidance → 80/20 or a modified 50/30/20).

Remember, you can also adapt the 50/30/20 rule. If 50% isn't enough for needs, try a 60/20/20 or 70/20/10 split. If you need to save more, try a 50/20/30. The percentages aren't sacred; your financial security is .

The Bottom Line: Your Budget, Your Rules

The 50/30/20 rule is a helpful starting framework for financial novices with relatively stable, proportional finances. Its greatest strength—simplicity—is also its greatest weakness. In 2025, with diverse income streams, varied living costs, and personalized goals, a rigid, one-size-fits-all formula often creates more frustration than freedom .

Don't force your unique financial life into a predefined box. Whether you choose to modify the percentages, adopt the zero-based method, or start with the 80/20 simplicity, the goal is the same: to build a conscious, intentional plan for your money that moves you toward your goals. That's a rule worth following.