Compound interest grows your retirement savings like a tree—starting from a small seed and expanding exponentially over time.

What if your most powerful employee for retirement wasn't you, but your money working tirelessly around the clock? This isn't a fantasy; it's the reality of compound interest. Often hailed as the "eighth wonder of the world," compound interest is the financial engine that can transform modest, regular savings into a substantial retirement nest egg without requiring Herculean effort or a massive salary. It makes retirement easier by doing the heavy lifting for you, turning time into your greatest financial asset.

The Stunning Power of Small, Consistent Action

Believe it or not, investing just $6.66 per day—roughly the cost of a specialty coffee—from age 25 could grow to over $1 million by age 65, assuming a historically conservative 10% average annual market return. Your total contribution would be about $96,000, but the gains from compounding would contribute a staggering $904,000. That's the "miracle" at work.

Demystifying the "Magic": How Compound Interest Works

At its core, compound interest is simply "interest earning interest." Unlike simple interest, which is calculated only on your initial deposit, compound interest calculates returns on both your principal and the accumulated interest from previous periods. This creates a snowball or domino effect, where growth accelerates dramatically over time.

The Compound Interest Domino Effect

Watch how your money starts to work for itself in just a few cycles:

You contribute money to your retirement account (e.g., 401(k), IRA).

Your investment generates returns from dividends, interest, or capital gains.

Those earnings are automatically reinvested, buying more shares or assets.

Your now-larger balance earns returns on itself, repeating the cycle exponentially.

Simple vs. Compound Interest: A $1,000 Investment at 8%

This simple comparison over 30 years shows why compounding is a retiree's best friend. The gap starts small but becomes a canyon.

Interest is calculated only on the original $1,000 every year.

Year 30 Balance: ~$3,400

Growth is linear and limited.

Interest is calculated on $1,000 + all prior interest.

Year 30 Balance: ~$10,000+

Growth is exponential and powerful.

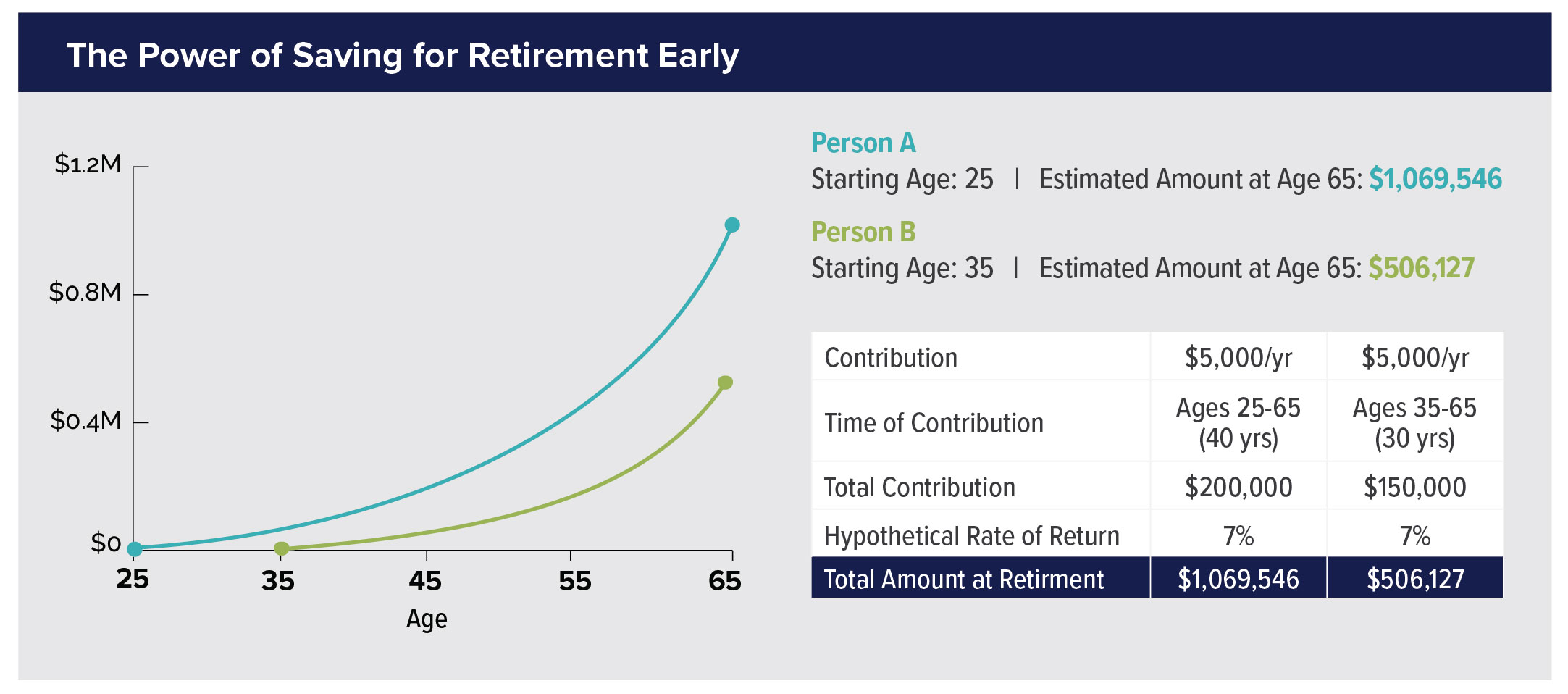

Your Greatest Advantage: Time (Not Timing)

The single most important factor in harnessing compound interest isn't picking the perfect stock; it's starting as early as possible. "Time in the market is far more important than timing the market". Every year you delay costs you exponentially more in the long run because you miss out on entire cycles of compounding.

The Early Starter (Age 25)

Emily invests $440 per month starting at age 25. By the time she's 67, assuming a 6% return, her nest egg tops $1 million.

Compound Growth Does The Rest.

The Late Starter (Age 30)

Her friend Elliot waits just 5 years. To have the same $1 million at 67, he must invest $613 per month (a 7% return).

Cost of Waiting: $50,000+ More From His Pocket.

A five-year delay doesn't just mean catching up—it means paying a steep premium for lost time.

Making It Work For You: Practical Strategies

Understanding compound interest is one thing; putting it to work is another. Here’s how to integrate this power into your retirement plan:

Your 3-Step Action Plan to Harness Compounding

Start this process today to put the most powerful force in finance on your side.

- Start Now, With Anything: Open a tax-advantaged account like a 401(k) or IRA. If your employer offers a match, contribute at least enough to get the full match—it's an instant 100% return.

- Automate Consistency Set up automatic payroll deductions or bank transfers. Consistency turns compounding from a concept into a relentless wealth-building machine.

- Invest for Growth & Ignore Noise: For a long timeline (20+ years), a diversified portfolio leaning toward stock-based index funds (like S&P 500 ETFs) has historically provided the growth needed for compounding to shine. Stay invested through market swings.

The Tax Advantage Turbocharger

Using retirement accounts like 401(k)s and IRAs supercharges compounding by shielding your earnings from taxes each year. In a taxable account, you'd pay taxes on dividends or capital gains annually, which slows the compounding process. In a tax-advantaged account, 100% of your returns stay invested and keep compounding year after year, dramatically accelerating your growth.

“Someone's sitting in the shade today because someone planted a tree a long time ago.”

Compound Interest: The Ultimate Retirement Stress-Reduction Tool

Beyond building wealth, compound interest provides profound psychological benefits. It transforms retirement planning from a source of anxiety into a system of quiet confidence. By starting early and letting the math work, you:

- Reduce Monthly Pressure: You don't need to save impossible amounts later in life.

- Build Resilience Against Inflation: Exponential growth helps ensure your savings outpace rising costs over decades.

- Gain Peace of Mind: Knowing your money is systematically growing in the background reduces financial stress and lets you focus on living your life.

The Final, Simplest Truth

Compound interest makes retirement easier by rewarding the simplest good habits: starting early and being consistent. You don't need a windfall or a complex strategy. You just need to begin, preferably today, and let the relentless, exponential math of compounding do what it has done for generations—turn time and patience into profound financial security.

The most expensive retirement mistake isn't a bad investment; it's waiting to make a good one. The best time to plant the tree was 20 years ago. The second-best time is now.