Debt traps are often designed to be easy to fall into and hard to escape.

The average American carries over $100,000 in debt, a number that keeps growing . While overspending is often blamed, the deeper truth is that many are ensnared by systemic traps and psychological cycles that make escape feel impossible. A debt trap is more than a single bad loan; it's a situation where the cost of your debt exceeds your income, forcing you to borrow more just to keep up, creating a vicious cycle .

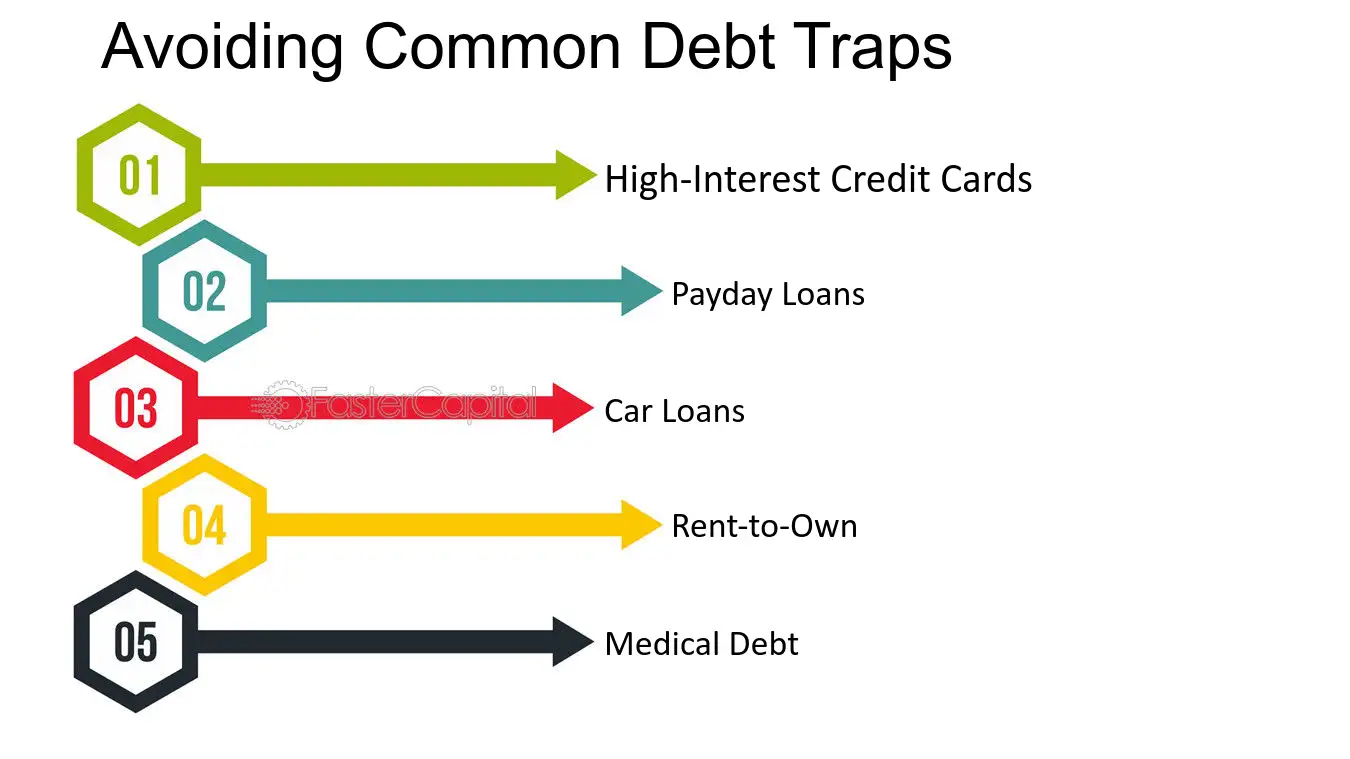

This guide exposes the eight most common debt traps—from predatory financial products to invisible mental patterns—and provides the clear exit strategy for each. Understanding these traps is your first and most powerful step toward breaking free.

“A debt trap cycle happens when people spend more money than their income and borrow against credit to spend more... You are chasing instead of paying off your debt.”

Trap 1: The Predatory Lending Cycle

When traditional credit is out of reach, desperate borrowers turn to high-cost alternatives that create immediate, long-term disaster.

Payday Loans & Cash Advances

The most dangerous quick-fix

How it Traps You: Marketed for emergencies, these loans have astronomical fees and APRs that can reach 400% or more . Borrowers often cannot repay the full amount by the next paycheck, leading them to take a new loan to cover the old one, starting a devastating cycle of debt .

🛡️ The Escape Plan: Seek any alternative. Options include a small personal loan from a credit union, a payment plan with the original biller, asking family for help, or even selling items. Building even a tiny emergency fund is the ultimate defense .

Trap 2: The "Convenient" Spending & Payment Traps

Modern financial products are designed to make spending easy and painless... until the bill arrives.

High-Interest Revolving Credit

The Trap: Carrying a balance on high-APR credit cards is one of the costliest common debts. A $1,000 purchase can balloon if you only make minimum payments . This is worsened by using cards for cash advances, which have even higher rates and fees .

Buy Now, Pay Later (BNPL)

The Trap: These point-of-sale plans break purchases into small installments, encouraging overspending on wants . While often interest-free, late fees are steep and missed payments can hurt your credit. Managing multiple BNPL plans makes budgeting chaotic .

The Minimum Payment Mentality

The Trap: Making only the minimum payment is a surefire way to stay in debt for decades. It keeps you in good standing but directs most of your payment to interest, not the principal . Banks profit handsomely from this "slow drip" approach.

Unified Escape Plan for Spending Traps

Rule #1: If you can't afford it with cash/debit, don't buy it with credit . Treat BNPL like a credit card.

Rule #2: Always pay more than the minimum. Even an extra $20 significantly cuts your interest and timeline .

Rule #3: Target highest-interest debt first (Debt Avalanche method) to save the most money .

Trap 3: The "Smart Financial Move" Traps

Some of the most seductive traps are disguised as savvy financial strategies.

Dangerous Debt "Solutions"

The Risk: HELOCs or home equity loans put your home at risk if you can't repay. Using them for vacations, cars, or daily spending turns secured debt into a dangerous liability .

The Risk: The initial low rate is tempting, but when it adjusts upward, your payment can skyrocket, potentially leading to foreclosure . You have zero control over future rate hikes.

The Risk: Taking a new loan to pay off old debts only works if you stop using the old credit lines. Otherwise, you end up with the new loan and new credit card debt—doubling your trouble.

✅ The Safe Path: Use home equity only for value-adding home improvements. Choose fixed-rate mortgages for predictability. Only consolidate debt with a locked-in plan to change spending habits.

Trap 4: The Psychological & Behavioral Traps

The most persistent traps aren't in your wallet; they're in your mind.

The Scarcity Mindset

The Trap: Constant financial stress can impair cognitive function as much as losing a night's sleep, leading to poor decision-making . This "tunnel vision" forces a focus on immediate crises, causing you to miss long-term opportunities, buy low-quality items repeatedly, and avoid investments in education or assets that could break the cycle .

Spending on Status vs. Assets

The Trap: Prioritizing visible symbols of wealth (luxury cars, designer clothes) over actual wealth-building assets . These are liabilities that drain money through payments and depreciation. Research shows many high-income earners drive modest cars while building invisible investment portfolios .

The Hidden Systemic Trap: Fees & The Poverty Penalty

For low-income earners, the financial system itself can be a trap. So-called "fringe banking" costs can consume a shocking portion of income .

The High Cost of Having Little

When you're living paycheck to paycheck, you're more vulnerable to fees that others avoid:

- Bank Fees: Monthly maintenance fees, overdraft charges, and out-of-network ATM fees can cost a low-income earner up to 10% of their income, compared to ~1% for higher earners .

- Lack of Access: Without access to affordable credit or the buffer of savings, any emergency forces a choice between a payday loan or a missed bill, both of which incur high costs .

- The Cycle: These fees directly drain the very funds needed to build savings, creating a barrier to financial stability .

Building Your Permanent Defense System

Escaping a trap is one thing; making sure you never fall in again is another. Your financial future depends on these foundational habits:

- Budget Relentlessly: "Everything's better with a budget" . A monthly, zero-based budget is your map and your early warning system. Update it every single month .

- Build the Emergency Fund: This is your shield against all traps. Start small, but aim for 3-6 months of expenses. This cash buffer prevents an emergency from forcing you into a payday loan or high-interest debt .

- Increase Financial Literacy: Knowledge is your greatest tool. Understand interest, fees, and the terms of any financial product. This protects you from scams and poor decisions .

- Shift Your Mindset: Move from scarcity to agency. Ask "How can I afford this?" instead of "I can't afford this." Focus on increasing income and optimizing large expenses, not just clipping coupons .

Debt traps are powerful, but they are not invincible. By recognizing the eight patterns outlined here—from predatory loans to self-sabotaging mindsets—you take back control. Your path to financial freedom starts with the decision to step out of the trap and onto solid ground.